Uniswap Exchange (UNI) is one of the top DeFi projects that came out of blockchain technology. A complete decentralized system that is independent of buyers and sellers for liquidity dependence. A shift has been observed among the users jumping from the usual exchanges to decentralized exchanges which are more user friendly and independent of anyone’s control.

The DeFi hype has already given birth to Binance DEX, a decentralized exchange by Binance after the tremendous success received by Uniswap.

This post will highlight everything you need to know about Uniswap DeFi and its ecosystem, let’s jump right in –

What is Uniswap Exchange?

Uniswap is an open-source decentralized exchange created in 2018 by Hayden Adams (in pic), a former engineer at Siemens. Inspired by the post written by the founder of Ethereum blockchain Vitalik Buterin, he created Uniswap on Ethereum blockchain in Solidity (the language of Ethereum). It is designed to trade tokens without the involvement of middlemen and platform fee charges. It does not depend on market makers for liquidity instead has liquidity pools to facilitate a smooth transfer. Something I will cover in the column on How Uniswap works.

Uniswap has recorded a user base of over 2.5 Million, trading cryptos

Uniswap supports the exchange of all the available ERC20 tokens created on the Ethereum blockchain. At the time of writing this article, Uniswap is among the top 10 DeFi exchanges by volume, it is currently ranked at number 2 in the list lead by Curve Finance.

What is UNI Coin?

UNI coin or UNI token is the native token of Uniswap decentralized exchange. It was created in September 2020 as a governance token for Uniswap DEX. Holders owning UNI has the voting rights in deciding how the Uniswap protocol should run (like Internet Computer ICP coin).

UNI was airdropped to all the users who have used the exchange prior to the launch of UNI token. A total of 400 UNI tokens were airdropped to every eligible account. It was an answer to its DEX rival SushiSwap – a fork of Uniswap that launched SUSHI tokens to incentivise the liquidity providers who migrated their funds from Uniswap to SushiSwap.

The total supply of UNI is limited to 1 Billion tokens

How Uniswap Works?

Uniswap runs on smart contracts and a mathematical algorithm to execute trades on the platform alongside liquidity pools that maintains the liquidity of available ERC20 tokens. It works on a unique pricing mechanism called “Constant Product Market Maker Model“.

Take for example, if I want to launch my own coin i.e KT coin on Uniswap. I have to create a new smart contract on Uniswap alongside a liquidity pool containing, let’s say $100 worth of KT coin and the same $100 worth of ETH token. The price of my token i.e KT coin is determined by a unique equation – X * Y = K where X and Y are the respective quantities of KT coin and ETH token. K is always a constant number that is derived initially when the equation was formed.

The initial price of coin is determined by the creator of the liquidity pool

This equation helps the system to understand the supply and demand of the respective KT coin. Whenever someone buys KT coin from the liquidity pool, the value of K goes down which means the supply of KT coin has decreased and the equivalent value of ETH token has increased in the pool. The system will understand this and increase the value of KT coin to keep K constant.

This means the value of any coin on Uniswap depends on the number of trades taking place on the exchange. It will only change if the trade occurs else will remain the same. This is unique about the decentralized exchange, it is not dependent on Market Makers for price determination and liquidity supply. It is automated and free from the control of centralized authority.

Each token has its own smart contract and liquidity pool

The liquidity providers are rewarded with special Pool tokens that represent their total share in the respective pool. They are also rewarded with 0.3% of the trading fee each time a trade takes place on Uniswap that uses the liquidity pool of respective tokens.

How to use Uniswap?

Trust me, you will get confused if you try using Uniswap for the first time. It won’t ask you to log in, never ask you to verify your identity and doesn’t even care which part of the world you belong to and the tax code you follow. That’s the beauty of decentralized exchange -“A smooth process with zero hindrance“. A pure business model in play.

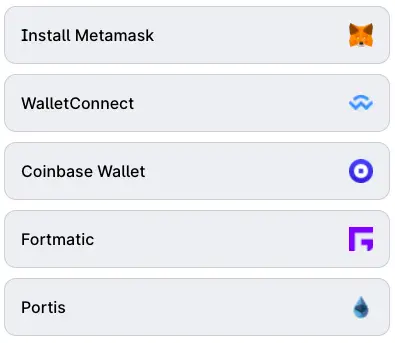

Using Uniswap is pretty easy. Visit uniswap.org and click the top right option to connect a wallet. These are cryptocurrencies wallets like MetaMask, Coinbase, Portis, Wallet Connect etc as shown below –

It is mandatory to hold ETH on any one of the given wallets you wish to connect with Uniswap. ETH is used to pay for the Gas or the transaction fee on the network. Once you have connected the wallet. It will present you with the two fields i.e top and bottom as shown below.

In the top field, select the ERC20 token you wish to trade. In this case, we wish to trade Brave Browser BAT coin in place of UNI token which is entered in the bottom field. In layman terms, we are selling BAT tokens to buy UNI tokens.

Once you have entered the respective tokens, click Swap. A window will appear that will give you a preview of the trade and prompt you for confirmation. Confirm the transaction and Voila! the trade will be executed successfully. Copy the transaction ID and visit Etherscan.io to check the complete status of the trade.

Uniswap vs SushiSwap:

SushiSwap is the top competitor of Uniswap in the DEX space. Head over to the detailed article on SushiSwap Crypto DEX and understand the difference & similarities between the two projects.

Uniswap Advantages:

Complete User Privacy:

Being a decentralized exchange, Uniswap offers complete user privacy. You do not have to create an account or verify your identity in order to access the platform and place a trade. Just connect your wallet and trade.

No Platform Fee:

Unlike traditional exchanges like NYSE, Zerodha or Coinbase. Uniswap doesn’t load the user with unwanted platform fees. A user will be charged with Gas fee or the network fee once he places a trade on the platform.

No Ownership Model:

Uniswap runs on a financial protocol that is hardcoded in Solidity. No single person or an organization will ever be able to control the exchange which means there will be negligible chance of price manipulation on the platform since it acts purely on the supply & demand model i.e Constant Product Market Maker Model as explained above.

ERC20 Token Compatible:

Built on the Ethereum blockchain, Uniswap supports all the ERC20 tokens ever created on the network. It is also capable of supporting the newly launched ERC20 token by allowing the liquidity provider to create a liquidity pool and decide the initial price of the respective token. Some of them are Decentraland MANA Coin, Enjin Coin and more.

Uniswap Limitations:

Not Multichain Compatible:

Uniswap is limited to ERC20 tokens only. A user cannot trade tokens that are not created on the Ethereum blockchain. Take for example Binance BNB Coin which was an ERC20 token before, now switched to its own blockchain i.e Binance Smart Chain is no more tradeable on Uniswap.

High Network Fee:

Uniswap has no control over the Gas fee charged by the Ethereum Network. Ethereum is already infamous for network congestion during peak trading hours, making it impossible to lower down the Gas fee, this shadows the advantage of the free platform fee on Uniswap. ETH2.0 upgrade is a ray of hope for Uniswap in lowering down the network fee but for that, we have to wait till mid-2022.

Pancakeswap Crypto DEX is leading Uniswap in this area by offering the lowest transaction fee

Impermanent Loss:

Impermanent loss is the loss of funds that can occur in decentralized exchanges when the ratio of tokens inside the liquidity pools become uneven. Though Uniswap has a system in place by organizing liquidity pools that contain stable coins to prevent the loss. However, the system is still susceptible to impermanent loss.

Smart Contract Bugs:

The DAO hack that led to the creation of Ethereum Classic (ETC) is the perfect example of a bugged smart contract. A large part of Uniswap functionality depends on smart contracts. Even a small bug in the smart contracts related to an ERC20 token can potentially expose the whole system.

UNI Airdrop:

In the month of September 2020, Uniswap airdropped UNI tokens to every wallet that have interacted with the platform prior to the announcement of the airdrop. A total of 150 million UNI tokens were airdropped of which 66 million UNIs were claimed in the first 24 hours.

Uniswap has planned to complete the process of allocating 1 billion tokens in the coming 4 years with 60% to be allocated to the UNI community, 21.5% to Uniswap employees and the remaining 18.5% to investors and advisors.

Uniswap UNI Coin Price:

Please check the latest Uniswap Coin price, shared below –

UNI Coin Price Prediction:

UNI coin rose to an all-time high of $55 in the last bull run of 2021 followed by falling down to the price level of $13 in the recent market crash. UNI is fairly new to the crypto world and most of the budding crypto investors are still unaware of the opportunities DeFi exchanges like Uniswap has to offer.

The daily transaction volume of Uniswap has been recorded at over $100K with more and more users interacting with the platform. However, Ethereum’s network congestion has slowed it down which has resulted in higher Gas fees, hence a fall in user’s interest.

Overall, things look on the brighter side after the ETH2.0 rollout announcement and Ethereum acceptance as a priority blockchain when it comes to creating DAPPS and Smart contracts. Given the positive sentiments, I totally believe UNI coin to hit the price level of above $100 mark in the upcoming bull run coupled with the rise of DAPPS and Smart contracts on the Ethereum blockchain.

1INCH Coin, the native token of 1INCH DEX aggregator can be an alternate investment option

How to Buy UNI coin?

UNI coin is available to trade on all the leading exchanges including its DeFi platform. You can purchase UNI on Binance, Coinbase and every other known crypto platform.

If you’re in India and wish to purchase UNI coin, you can visit the WazirX exchange which is the largest cryptocurrency exchange in India by volume. Acquired by Binance in 2019, you can check out the details on account creation and trade placement on my post on How to buy Bitcoin in India – WazirX review.

DeFi is still in its nascent stage and Uniswap is one of the top projects

Should you invest in Uniswap UNI Coin?

Uniswap is probably the first generation DeFi exchange that has proven its mettle on the Ethereum blockchain. After the announcement of Binance DEX by Binance. It is clear, DeFi is here to stay. Betting on Uniswap won’t be a bad idea altogether.

Having said that, if you’re amused by the new DeFi system and believe in its adoption by the masses, count Uniswap to be one of your investment choice else you can look for other blockchain technologies like Cardano (ADA) and Polkadot (DOT) if DeFi is not your thing.

This covers my complete review of Uniswap Exchange UNI coin. In the next post, I will talk about Shiba Inu Coin and Enjin Coin. Do remember to subscribe to my newsletter and please do share the post on your social media handles to educate your circle by spreading the right knowledge.

DISCLAIMER:

Cryptocurrency is a highly volatile market. All the information shared in the post is for knowledge purpose only. By no means, it’s financial or investment advice. Readers are responsible for their own investment decisions and should only invest in cryptocurrency after proper research.

[post_grid id=”6111″]

Paras is a blockchain writer & video creator at Katoch Tubes. In his free time, he loves watching space exploration documentaries & Hollywood movies.