The DeFi (Decentralized Finance) space is expanding by leaps and bounds and AAVE has arrived at the right time. AAVE Crypto is the first project to introduce lending i.e loans to the general public using the power of cryptocurrency. If you’re following my recent posts, you must have known the top decentralized exchanges (DEXes) i.e Pancakeswap crypto exchange & Uniswap exchange.

While Exchanges primarily deal in the trading of crypto assets by swapping. AAVE on the other hand follows a lending protocol that issues crypto assets to the borrower with set conditions. The concept of lending and borrowing isn’t new, it became mainstream with banks lending money to the general public for a specific period of time by charging interest on the principle. Simple school math, remember!

The concept of cryptocurrency lending is fairly new, as such, it is important to understand the know-how of the platform. Questions like – Is the platform safe? Is my deposit safe? How to borrow money? What are the supported coins by AAVE? and many such questions will be answered in the post including AAVE coin price prediction. Why wait more, let’s explore AAVE –

What is AAVE Crypto?

AAVE crypto is the first open-source, decentralized lending platform built on blockchain technology (starting with Ethereum blockchain). The users can access the platform by becoming depositors or borrowers. Depositors provide the necessary liquidity to the AAVE market and borrowers can take a loan by pegging collateral against the loan amount.

AAVE was founded by Stani Kulechov in 2017, registered in Switzerland. AAVE was initially ETHlend that runs its lending services on the Ethereum blockchain. ETHlend worked like Amazon marketplace for lenders and borrowers where both the parties can negotiate the deal and stamp it on a smart contract.

Though the platform was somewhat successful, it picked up pace after the change of vision and platform upgrade to AAVE making it a much better protocol targeting retail and institutional investors.

Speaking of today, AAVE is ranked among the top lending platform in the crypto space and is consistently ranked in the top 2 spots challenging MakerDAO & Compound.

Users can lend and borrow across 22 different crypto assets

What is AAVE Coin? Aavenomics

AAVE coin is the native token of AAVE protocol. It’s an ERC20 compatible token that integrates EIP2612 function. The EIP2612 permit function allows the payment of gas fee in the respective ERC20 token rather than using ETH, saving the platform with high gas fee issues during network congestion.

Initially, during the ICO & before rebranding itself, ETHlend has its native token LEND which was later migrated to AAVE in the ratio of 1:100 (100 LEND per 1 AAVE) after the launch of AAVE token in October 2020. I will cover the ICO later in the post.

AAVE token has 3 key roles to play within the AAVE protocol –

- Governance

- Staking

- Risk Mitigation

- Ecosystem Incentives

Governance:

AAVE holders can participate in the protocol governance by staking AAVE tokens on the network. The process is initiated by creating onchain AAVE Improvement Proposals (AIP). The community creates, evaluates and signals the proposed AIP. It is then passed to the genesis team which then implements and submit it to the governance. The governance evaluates the implementation and decides whether to approve or reject the said proposal.

The proposals created by the community should fit into any of the three types of policies defined by AAVE. These are Risk policy, Monetary policy and Improvement Policy.

Staking:

When it comes to AAVE, staking is quite different from regular staking methods. AAVE use Safety Module (SM), a staking mechanism that protects it from insolvency. It locks AAVE tokens that act as insurance against the Shortfall (dearth of liquidity providers). Users staking in the Staking Module will get rewarded with AAVE tokens along with a percentage of protocol fees.

The second method of staking AAVE tokens is using the Balancer pool. User has to deposit staked asset (from Safety Module) in AAVE/ETH pair to earn BAL tokens and part of the trading fee as rewards.

Risk Mitigation:

AAVE token is not just used for governance or staking, it also plays an active role in risk mitigation. In an event of insolvency or lack of liquidity, the protocol will deploy AAVE token from its staking pool and prevent the system from collapsing.

30% of staked tokens in the Safety Module will be slashed in an event of Shortfall

Ecosystem Incentives:

AAVE tokens are used to periodically incentivise liquidity providers, integrators and software developers to attract more users on the platform in a different capacity.

AAVE is a deflationary currency. 80% of fees collected by the protocol is used to burn AAVE tokens and the remaining is used to pay the lenders and stakers as incentive.

Total supply of AAVE tokens are capped at 16 Million

How does AAVE work?

Imagine going to the bank and applying for a loan by submitting the paperwork and getting approval based on the credit score. Feeling tired already? Now imagine sitting at home and getting the loan without identity proof, credit score and paperwork requirement. How does that feel? Well, that’s how AAVE work.

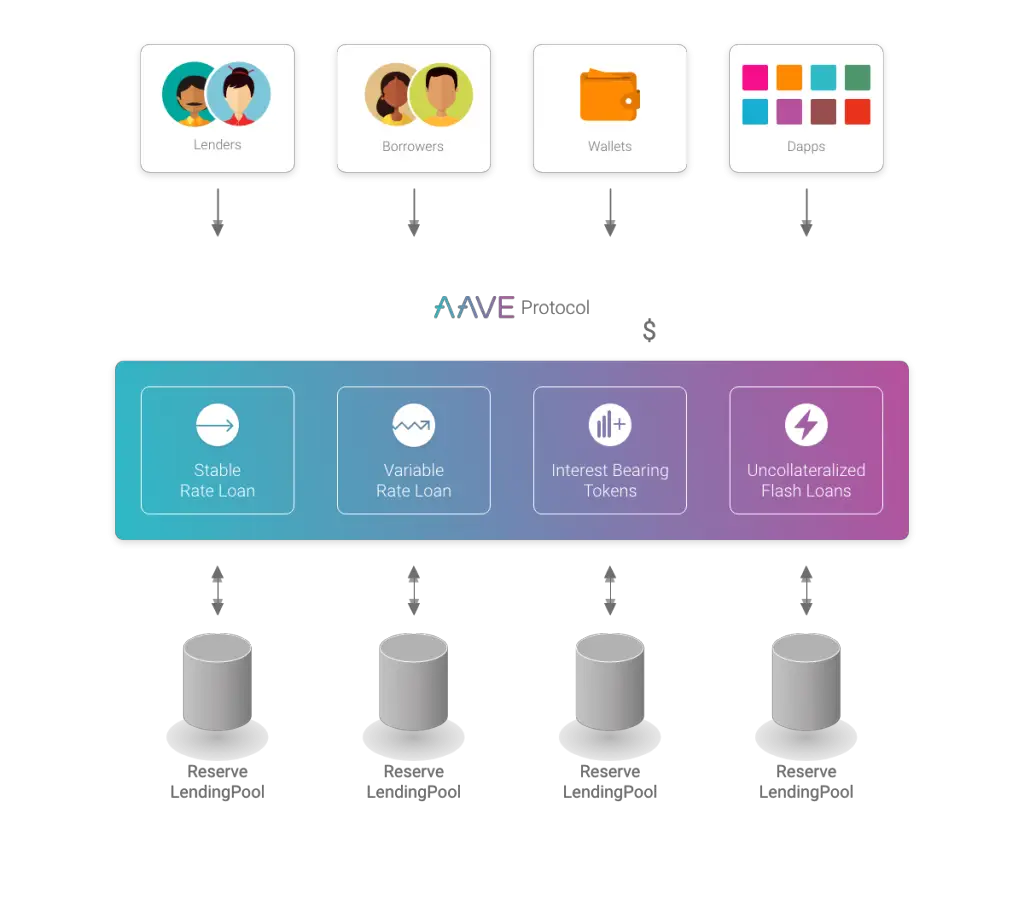

AAVE allow users to lend and borrow cryptocurrencies on its platform in a decentralized manner without third party involvement. Lenders deposit funds on AAVE lending pools and borrowers can then access the platform to get a loan. Part of the deposited funds go to the reserve pools which act as a backup in case the liquidity falls below the desired level. This also allows the lenders to withdraw funds at any time.

AAVE offers two types of loan options –

- Overcollateralized loan

- Uncollateralized loan (Flash loan)

Overcollateralized loan:

Overcollateralized loans require the borrower to deposit or lock an amount that is larger in USD compared to the withdrawn amount in USD. If the USD value falls below the required collateral threshold, the asset is posted for liquidation at a discount price which can be purchased by anyone interacting with the platform.

Here’s an example, If you’re a borrower and you want USDT to purchase a newly listed coin on an exchange. You can deposit eligible assets, let’s say ETH on AAVE whose value in USD should be greater than the value of USDT. Let’s say you deposited $100 worth of ETH to get USDT. Since it’s an overcollateralized loan you will receive back $75 worth of USDT.

The received amount varies between 50-75% (of the locked amount) depending upon the asset type.

Flash Loan:

Flash loan is the uncollateralized loan introduced by AAVE. It works like instant fund transfer without the need for collateral, provided the liquidity should be returned to the pool within the next block creation (13 seconds on Ethereum), making it a time-bound loan.

If the said condition isn’t fulfilled, the whole transaction is reversed and nullified. Though the loan is issued for a very short period of time, it can be used to make high arbitrage profit and refinance loans.

To initiate a flash loan, user need to build a contract with set conditions that requests Flash loan. The contract will then need to be executed with instructed steps, paying the loan fee and the loan amount within the completion of next block.

Flash loans are designed for developers with a chargeable loan fee of 0.09%

Want to create Flash Loan without using code? Try collateralswap or defisaver.

AAVE aTokens:

aTokens are special tokens which are issued to the depositor by the protocol in return of the funds deposited on its lending pool. It works similar to Liquidity Pool (LP) tokens issued on decentralized exchanges like Sushiswap crypto exchange.

aTokens are pegged in 1:1 ratio of the underlying asset deposited on the platform and the interest earned on these tokens can be transferred directly to the user wallet. Moreover, these tokens can also be swapped on Uniswap exchange & the holder of aTokens has complete control of the deposited funds.

For example, 100 BAT tokens deposited will issue 100 aBAT tokens.

aTokens are minted at the time of fund deposit and burnt when redeemed.

AAVE Interest Rates:

AAVE issues two types of interest rates i.e stable and variable. The stable interest rate is calculated from the average of the last 30 days of the interest rate for the underlying asset while the variable interest rate depends on the pool liquidity and utilization rate. A high utilization or demand of an asset will attract higher interest rates and vice-versa. Borrowers can switch to any of these interest rates at any point in time by paying a small gas fee.

AAVE Crypto ICO:

The ICO was launched way back in 2017 when AAVE was still ETHlend with its native token LEND. LEND was an ERC20 token that was issued in the ICO at $0.016 USD per token. Out of the total supply of 1.3 billion, 1 billion were sold in the ICO, raising over $16 million and the remaining was issued to the AAVE team members.

Later in 2020, LEND was migrated to AAVE in a 1:100 ratio (100 LEND to 1 AAVE). As we speak, AAVE took over and became the native token of the platform which by nature is delfationary.

What is AAVE V2?

Launched on Dec 03, 2020, AAVE V2 is an upgrade to the AAVE V1 protocol. It brings some noteworthy improvements to the platform. Check out AAVE V2 Protocol.

AAVE Crypto Benefits:

Multichain:

Started on Ethereum as a peer to peer lending protocol (ETHlend). AAVE has developed itself into a multichain lending protocol that runs on popular blockchain like Polygon MATIC, Avalanche crypto blockchain, making itself accessible to large number of users. Hence, more liquidity.

Audited Protocol:

Since it’s launch, the protocol has been audited 17 times by top security companies like CertiK, MixBytes & PeckShield, adding credibility to the platform and increasing trust.

Safest DeFi Protocol:

AAVE received an Economic Safety grade rating of 95% from Gauntlet Simulation Platform making it the safest DeFi platform when it comes to addressing platform risks like security risk, governance risk, market risk and oracle risk.

No KYC Required:

AAVE is a decentralized platform that doesn’t require any kind of identity proof to run it’s protocol. No document submission, No photo upload and No account creation. All you need is AAVE compatible wallet like MetaMask, Trust Wallet etc. and you’re all set to use the platform. It’s that simple.

AAVE Crypto Drawbacks:

Slashing:

As discussed in the post, AAVE will slash 30% of the staked tokens in an event of Shortfall, which is the lack of liquidity within the pools. The chances are less but possibilities are always there. Lenders can lose 30% of their wealth staked on AAVE in an instant.

Missing Institutional Investors:

Institutional investors play a pivotal role in driving lending platforms. At the time of writing, AAVE is trying hard to attract institutional investors on its platform. However, there’s still a long path to travel before we can hear the big news.

Competition:

AAVE is among the top 3 lending platforms but there’s cutthroat competition in the DeFi space. To stay in the race, it has to match and win against its competition every second. Only time will decide the winners once the consolidation phase starts in the DeFi space.

Not for Regular users:

The majority of the users engaged in traditional platforms are not technically literate to use its services, leaver aside the Flash Loan contract creation that requires good coding skills. This may result in slow adoption rate even if the world opts for blockchain technology.

AAVE Price:

Please check the latest AAVE price, shared below –

AAVE Price Prediction:

AAVE Crypto made an impressive debut on the day of its launch in October 2020 by opening at $50 per token (after migrating from LEND). Soon after, AAVE updated protocol V2 was launched in December 2020 which further boosted the price per token and it was quick to reach beyond $650 mark in the bull run of 2021.

Later in the market crash, like any other coin, AAVE went downhill and hit a yearly low of $170 before stabilizing in the range between $200 – $400 as shown in the image.

After going through the whitepaper and reading the V2 update. I am pretty sure the project is targeting institutional investors to use its platform for lending and borrowing services. If it’s successful in doing so, you’ll witness the price go beyond the $1000 mark. On the flipside, especially in an event of a Shortfall, it can go below the $100 mark. AAVE looks quite bullish at the moment but who knows anything can happen in the crypto industry.

How to Buy AAVE Crypto Coin?

From DEXes to centralized exchanges, AAVE can be purchased from every leading platform. Centralized exchanges include Binance, FTX, KuCoin, Kraken and more. Talking about decentralized exchanges, Uniswap and Sushiswap are the leading DEXes when it comes to swapping AAVE tokens.

Remember, as a lender you can also trade aTokens on the Uniswap exchange.

Is AAVE Crypto worth investing?

Since its inception in 2017, AAVE has come a long way from changing its name to launching the updated versions in a timely and thoughtful manner. The platform has garnered over $200 million in total deposits and is ranked among the top 3 crypto lending platforms by volume.

Being audited by top security firms has provided the necessary credibility and ratings that a DeFi product needs to gain trust from the users. If this wasn’t enough, AAVE also received an Economic Safety grade rating of 95% which is one of the highest in this space.

Backed by a strong team and visionary founder. The project is hoping to onboard institutional investors and that can be seen when it smoothens up the processes in V2 like Collateral swap. Everything looks positive when you dig in and explore. However, at the end of the day, it all boils down to global acceptance of DeFi protocols and making them mainstream.

DeFi is in the early stages of adoption and the government bill has the power to make or break its ecosystem. If you’re a fan of decentralization and support the DeFi movement. AAVE is one of the top projects you should keep your eyes on. Remember to invest after due diligence.

This completes my review of AAVE crypto. In the next post, I will talk about PAVIA crypto Metaverse and The Graph Crypto protocol. If you’re a fan of blockchain technology then please do share this post on your social handles and educate everyone around you. Do remember to subscribe to my YouTube channel for more informative content, released every week.

DISCLAIMER:

Cryptocurrency is a highly volatile market. All the information shared in the post is for knowledge purposes only. By no means, it’s financial or investment advice. Readers are responsible for their own investment decisions and should only invest in cryptocurrency after proper research.

[post_grid id=”6111″]

Paras is a blockchain writer & video creator at Katoch Tubes. In his free time, he loves watching space exploration documentaries & Hollywood movies.