Blockchains that call themselves Ethereum killers have never heard of Solana (SOL) crypto blockchain. In the year 2017, when the crypto industry was booming, Solana founders silently published the whitepaper. It was only in 2020 when this amazing cryptocurrency caught the attention and came into the limelight after being noticed by the tech giants and the masses. Today I am going to unfurl its details in this post. Let’s talk Solana (SOL) –

What is Solana Crypto Blockchain?

Solana is a secure open-source and decentralized blockchain that supports decentralized apps, smart contracts and marketplaces. It was founded in the year 2017 by Anatoly Yakovenko, a tech engineer who worked in ace companies like Qualcomm and Dropbox before jumping into his venture. Solana is by far the fastest blockchain in the crypto industry that works on Proof of Stake (POS) protocol in combination with Poof of History (PoH).

I’m at the @solana store in NYC!!! @solanaspaces pic.twitter.com/0BN9AJag0c

— Ayoola John (@web3aj) September 11, 2022

Solana can process 50,000 – 65,000 transactions per second

What is Solana (SOL) token?

SOL is the native currency of the Solana blockchain. It is used to validate the network transactions, secure the network and run the on-chain programs. Moreover, SOL is also used for staking to earn rewards within the Solana crypto blockchain.

The use case of SOL token is somewhat similar to Cardano ADA and Ethereum ETH tokens, indicating SOL to be a potential store of value for the HODLers and investors.

The total circulation supply of Solana is limited to 500 Million

Solana Crypto – Core Innovations:

1. Proof of History (PoH):

Proof of History is a cryptographic clock within the Solana blockchain. It’s one of a kind feature that qualify nodes to establish the time order of the events within the network, without having the need to signal each other every time an event takes place.

Though it sounds similar to blockchain protocols like POW and POS, it is not a consensus mechanism. PoH helps create more efficiency by keeping the records of every transaction and allow the system to keep a track record of the events on the network.

In Solana blockchain, each node has it’s own clock

2. Tower BFT:

Tower BFT stands for Byzantine fault tolerance. Like Cardano Ouroboros algorithm, it is a consensus algorithm that takes the cryptographic clock feature into account and reaches the consensus faster by eliminating the need to message each node for the validation of process completion, hence increasing the overall transaction speed.

3. Gulf Stream:

Gulf stream is a protocol that conducts transaction caching and sends it across all the nodes in the network. This enables Solana to hit the impressive 50,000 transactions per second mark by allowing the validators on the network to execute transactions ahead of time.

4. Turbine:

Turbine breaks the big data into small packets that make the data transfer faster and easier among the nodes. Hence reducing the possible issue of network congestion and bandwidth requirement.

5. Sealevel:

To some extent, Sealevel is similar to Sharding, explained by me in Cryptocurrency terminology. It helps the system run parallel processes on the same chain that results in faster transaction speed.

6. Pipelining:

Pipelining is used for validation optimization. It is a process of priority assigning the stream of data to different hardware devices for faster processing of transaction information.

7. Cloudbreak:

Cloudbreak is a database structure in particular. It is required to better network throughput and make it more scalable.

8. Archivers:

As the name suggests Archivers are used to store network data. It’s a distributed ledger storage device that captures and keeps a record of the data on the network, like a hardware drive storing your movie files.

It’s #TrustWalletTuesdays! And we’re excited to announce that we’ve added support for @Solana dApps!

— Trust – Crypto Wallet (@TrustWallet) September 13, 2022

Connect to #Solana‘s top #dApps easily with your #TrustWallet.

Find out how to in our guide and full announcement below👇

How does Solana Work?

Frankly speaking, Solana is wildly complicated (more complicated than Internet Computer ICP coin). Let me explain it by taking a hypothetical example.

Suppose there’s a decentralized college of highly skilled professors (nodes) with no confirmed principal (leader). Each professor is specialized in his core subject area, let’s say Geography, History, Finance etc and also, all of them are experts in every other department of the college.

Subsequently, each professor gets randomly picked to be the principal for 1.6 hours at a time, during which he has to perform the assigned paperwork coming from every other department (Solana takes 400 ms to create a block and the assigned leader is tasked to rotate 4 blocks at a time which gives a total time of 1.6 seconds).

Although the selection process is quite random (leader selection), every professor has a tablet that provides the list of the 10 upcoming principles for the given time. This enables every department to send across the paperwork beforehand for faster completion (Gulf Stream).

Whenever the principal in charge completes and signs the paperwork, a timestamp is created on the document before sending it back to the concerned department (Proof of History). Since every activity is timestamped, each department can run its own processes in parallel without confusion (Sealevel).

Each professor has a mandatory role in storing and checking the paperwork. He has to make sure that the principal is performing his duties well without any lag. This is how Solana blockchain works.

Solana vs Ethereum:

| Based on | Solana (SOL) | Ethereum (ETH) |

|---|---|---|

| Mainnet launch | March 2020 | July 2015 |

| Total Supply | 500 Million | Unlimited |

| TPS | 50,000 | 1500 |

| Protocol | POS assisted by PoH | POS |

| Projects | 400+ | 1500+ |

| Popularity | Medium | Very High |

Solana Benefits:

High Transaction Speed:

Solana is the only blockchain that promises a whopping 50,000 transactions per second. No other blockchain is closer to this number and most of them are still under development.

NEAR Protocol is its top competitor which can process 100,000 transactions per second

Strong Team:

Solana is powered by the core team with relevant experience in designing distributed systems and compression algorithms. The founders of the company have worked in tech giants like Qualcomm and Dropbox. The team is well versed with blockchain technology and very clear about the scope of work which clearly reflects in the growth of the project.

Financially Stable:

At the time of writing this post, Solana is funded by 28 investors, the total funding amount stands at $335.8 Million making it one of the most stable crypto projects in the cryptocurrency space. (Source: Crunchbase)

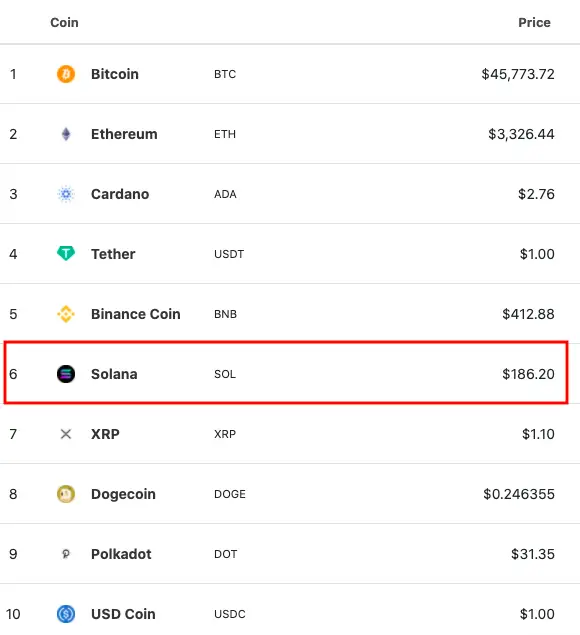

Store of Value:

Solana SOL token has gained a lot of appreciation this year and made it to the list of top 10 cryptocurrencies by market cap. Clearly, it is highly considered as an appreciating asset by cryptocurrency investors for long term investment. Making it a lucrative store of value.

Solana Drawbacks:

Missing the Roadmap Milestones:

Solana has consistently missed the milestones created as part of its roadmap plan. Its Mainnet is still in the beta stage and there’s a lot to be worked on before making the system fully functional. Having said that, the team is able to onboard big partnerships from the likes of FTX Serum Dex, Chainlink and Tether.

Rise of Competitors:

Solana stands tall in terms of critical tech factors like TPS, security etc. However, the major threat to its growth comes from the competitors like Polkadot, Ethereum and Cardano. All of them are pushing for the same spot. The game is heating up with the increase in blockchain adoption.

Solana Partnerships:

Solana was quick to grab the opportunity and onboarded interesting partnerships to strengthen its ecosystem. The important one’s are project Serum DEX in partnership with FTX to develop next-gen Defi exchange.

The second is with Chainlink crypto for building a super-fast oracle that can give price updates every 400 ms. The third major partnership comes from Tether to bring in a stable USDT to Solana’s ecosystem. Check out the major Solana Partnerships that are boosting the growth of its ecosystem.

Solana Moments:

From onboarding the Helium network to launching its own smartphone, Solana has stirred the pot even in the down market. Despite the Solana Wallet Hack, the event that cost investors over $7 million, more projects want to be associated with the layer-1 chain and are opening up to using Solana as their preferred chain.

we spent months evaluating potential L1’s and scaling solutions, and it’s my opinion that @solana is by far the best choice for @helium. i’m so impressed with what @aeyakovenko @rajgokal @garious14 and team have built

— amir.hnt (🎈,🫡) (@amirhaleem) September 12, 2022

HIP70 voting opens in an hour!https://t.co/g7HuaJwYen

Moreover, Solana’s entry into the mobile market has raised eyebrows and made it the first web3 company to do so. Equipped with Solana-supported wallets & related web3 features, the Smartphone SAGA is all set to reach consumers in 2023.

Audius Coin is actively working with Solana to build its layer 2 protocol

Solana Price:

Please check the latest Solana price, shared below –

Solana Price Prediction:

Despite the development delays. Solana brings its strong tech aspects which makes it stands out and compete with potential blockchain projects. Its ecosystem is developing at a rapid pace with more developers working on developing DAPPS and smart contracts. The increase in price levels is a clear indication of rising demand.

Solana SOL has reached an all-time high of over $200 and an all-time low of $20 during the recent uptrend and market crash. After studying the project potential and key partnerships (which includes the onboarding of Terra LUNA stablecoin on its blockchain), it’s not hard to say, Solana is here to for the long haul.

I wouldn’t be surprised if the project tried to mimic the growth of the Ethereum blockchain and hit $500 mark in the upcoming bull run. Having said that, you must keep the benefits and drawbacks in mind before investing in the digital asset and make an informed decision.

Checkout Star Atlas, the first Unreal Engine 5 powered game built on the Solana blockchain

How to buy Solana?

Buying any cryptocurrency is a cakewalk nowadays. You can buy SOL from Binance, Poloniex etc, and if you’re in India, try WazirX cryptocurrency exchange. Wazirx is the subsidiary of Binance and a secure platform to buy, sell or hold digital assets.

Create an account on the platform, get the KYC done and that’s it, you’re all set to purchase the cryptocurrency of your choice. If you’re looking for assistance, please read my post on How to buy Bitcoin in India on Wazirx.

Should you invest in Solana?

Solana crypto was able to capture the much-needed market attention in a very short period of time. Not only it was able to attract key investments but also brought the right partnerships to the table. Though the lag in project development still poses some challenges but that doesn’t stop it from becoming the next big thing once it goes live with the stable release.

I am bullish on the price and neutral on Solana. This blockchain is on top of my watchlist but there’re competitors to study before investing in any of these promising blockchains. I suggest you do your due diligence before investing in Solana or any other crypto coin in circulation.

This completes my review of Solana crypto with SOL token. In the next post, I will take you through the emerging cryptocurrencies – Polkadot crypto (DOT), Biconomy BICO coin and Ethereum Classic. If you like the post, please share it and educate your fellow friends. Do remember to subscribe to my YouTube channel for more informative content, released every week.

DISCLAIMER:

Cryptocurrency is a highly volatile market. All the information shared in the post is for knowledge purpose only. By no means, it’s financial or investment advice. Readers are responsible for their own investment decisions and should only invest in cryptocurrency after proper research.

[post_grid id=”6111″]

Paras is a blockchain writer & video creator at Katoch Tubes. In his free time, he loves watching space exploration documentaries & Hollywood movies.